Start Here >>>

This Occasional Paper was developed out of our response to HMG’s request for comment. We had more to say than we were asked for!

Invest 2035: The UK’s Modern Industrial Strategy Paper is the new Labour Government’s proposed UK 10-year plan for the economy.

The UK’s GDP is 3.73 US$ trillion and it ranks 6th in the world. Its GPD per capita is somewhere between 20th and 30th. The UK is $58,273. As comparison, Germany is $69,027 and Australia is $70,340.

Catching up would solve a lot of current issues.

Welcome to WorkingFree’s Easy Navigation Version: –

Kickstarting GROWTH – NOW!

An Occasional Paper from WorkingFree

Version 17 – 18.4.25

We need to recognise the fundamental changes that have and are taking place in the UK workforce and re-orientate all the available effort towards all businesses and their people selling more goods and services to more foreigners.

Here are about 21,000 words explaining how this should be done.

The inescapable problem is that the UK does not make a profit. In the 76 years since these records began, it has made a profit in only 18 of those years. It last made a profit in 1997. (Profit is more cash coming in than going out – the Micawber Principle!)

The Invest 2035: The UK’s Modern Industrial Strategy Paper is the new Labour Government’s proposed UK 10-year plan for the economy.

assets.publishing.service.gov.uk/media/6711176c386bf0964853d747/industrial-strategy-green-paper.pdf.

… and

commonslibrary.parliament.uk/research-briefings/cbp-7682/

It is probably the most ambitious, most technical and far-reaching-ever focussed Project of its type intended to take the UK on a quantum leap into the business and trade global future. It deserves to succeed.

But this is only one part – albeit a vital part – of their overall and comprehensive mission for the UK. They have also published several other documents that together, look like a major Transformation Programme for the UK over the next ten years. This project needs to be given a name. From all our perspectives, this Initiative must be as successful as their ambitions and the Country’s expectations demand.

Working Free welcomes this ambitious and well-thought-out Product but contends that their Transformation Programme does not cover implementation nor reflect the fundamental changes that have been – and are – taking place with people in the employment/ workplace segment of the UK economy. There needs to be an over-arching and detailed specific Process.

This Occasional Paper from Working Free identifies the prime drivers for the creation of national wealth and the best way of doing this is by more businesses and their people selling more goods and services to more foreigners. The Trump impact makes this instantly obligatory and urgent- as also is running the UK Nations much more efficiently. At the sharp end, this is what People do. This is Growth.

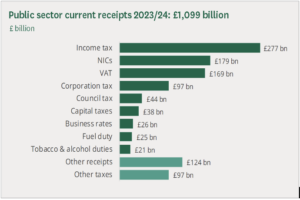

Growth is normally seen as increases in the Uk’s GDP – and its impacts on taxation. GDP is a measurement of size.

Size is about Businesses getting busier; new businesses with better products or services starting to get work; new work in new markets; finding new markets. All needing Individuals – in organisations or on their own – creating drive and delivering results. All in short supply.

See Postscript 4 – A bit more about Growth – GDP, Taxation and Exporting.

Main Points >>>

Main Points – Variables interact with Variables!

- The inescapable truth is that the UK has not made a profit since 1997 and only 18 times out of the 76 years since records began.

- Working Free has gathered virtually all of the government’s relevant published material and turned it into the UK’s National Transformation Programme. Working Free apologises to anyone who thinks this is an impertinence.

- Does the new Labour Government actually realise that this is what it is? Well done on defining the Product. Not much on the People bit. Even less about the Process.

- Working Free contends that 40% of the UK’s Total in Employment of 33,856 are NOT Full Time Employed Workers (FTEs). They are Atypical Workers – either detached or semi-detached from mainstream scrutiny and reach.

- THE UK’s Unemployment figure as now published is 4.4% – 1.56mn. WorkingFree thinks that the real figure should be 6.5%. If this is right, we ought to be more concerned – and curious.

- The split between Public Sector (including NHS for this purpose) and Private Sector is an intriguing debate. Split 24%/ 76%, Public Sector headcount is now 6.1mn. There is comment that it could really be as large as 10.6mn – or even more. This would change the split with private Sector- 37%/ 63% and would cost an estimatedextra £209bn. Lots to think about. By everyone.

- The year-on-year increase in Public Sector including NHS Headcount is 170k – Whether this is seen as a big figure or a modest increase – or even the right figure – is a judgement waiting to be made. Those interested should start at – The Working Free Approach – and cherry-pick what you read and/or follow the links.

- Civil Servants. These are included in Central Government. Currently, there are 548k of them – an increase of 19k over the previous year.

- Challenges Galore – See separate Sections for:- Growth. What is it? There are not enough people to do the work. So! What do we do now? (Some practical advice for genuine players shouted from the touchline!)

Trump got his current job by being hugely and noisily ambitious for the USA – and detailing what he was going to do and how he was going to do it – but he had the good sense to get foreigners to pay for it. The Labour Government should do the same.

The UK’s National Transformation Programme >>>

The UK’s National Transformation Programme.

(as described by Working Free who apologise to anyone who might see this as an impertinence.)

Invest 2035: is only one part – albeit a vital part – of this Programme. The Government has also published: –

- The National Wealth Fund (NWF) set up in 2021 and renamed last year from the National Infrastructure Bank.

- Make Work Pay – leading to……

- ………..the Employment Rights Bill, 10.10.24 – the first phase of delivering the Plan to Make Work Pay.

- Then came Invest 2035:

- …. and the Get Britain Working White Paper – 26.11.24.

- Government launched the Industrial Strategy Advisory Council ……..

- …….. and announced the members of the Industrial Strategy Advisory Council.

- More recently, the Foreign Secretary launched their UK Soft Power Council.

- The Department for Business & Trade’s “new global growth team“

- Skills England – proposed in 2024 and being launched in 2025.

The PM also published Six Milestones – here they are:

- Housing – A target to build 1.5 million homes and fast-track planning decisions on more than 150 more major economic infrastructure projects.

- Living standards – He promises higher living standards in every part of the UK, putting more money in working people’s pockets and delivering the highest sustained growth in the G7.

- Safe streets – He pledged 13,000 more police officers, PCSOs and special constables for the streets.

- NHS waiting lists – A target to meet the NHS standard for 92% of patients in England to wait no more than 18 weeks for treatment.

- Energy – Starmer promises to “secure home-grown energy” to put the UK on track to deliver at least 95% clean power by 2030, a step towards net zero.

- Children – A new pledge, Starmer promises to ensure a record proportion of 75% of five-year-olds start school “ready to learn”

Some more detail: –

- The National Wealth Fund (NWF) is a policy bank set up by the UK government to partner with the private sector and local authorities to finance infrastructure (and other) projects. Its purpose is to stimulate – or ‘crowd in’ – private sector investment into priority areas.12 Feb 2025.

- Make Work Pay and the Employment Rights Bill were designed to help more people to stay in work, support workers’ productivity and improve living standards.”

- The Employment Rights Bill is now going through Parliament and seen by many as expected from the Labour Government and generating a discussion as to what he word “Worker” meant.

- A common interpretation of WORKER has been “a member of a Trade Union”. Seen widely as restrictive. And by others as divisive.

- The Foreign Secretary and Secretary of State for Culture, Media and Sport have launched the UK Soft Power Council to drive UK growth and security. This is aimed at the heart of the UK’s services export activities. The launch date was 17.1.25. Smart move. Shame they did not do this at an earlier stage.

- The Department for Business & Trade’s New Global Growth Team is “tasked with driving international expansion and increasing business opportunities in new markets around the world, often comprised of trade envoys or specialists with regional expertise to identify and pursue potential growth areas abroad. Focus on international markets:, the primary goal is to identify and target new markets for export growth, investment attraction, and business partnerships overseas. “

- Skills England. Will be fully established in 2025. Skills England will play a critical part in the government’s mission to drive growth across the country, supporting people to get better jobs and improve their standard of living. Skills England I will develop the skills needs assessments set out in the first Skills England report with skill needs assessments for each of the 10 priority sectors and which feed into the ongoing Industrial Strategy planning process”

Why WorkingFree? >>>

Why WorkingFree?

A range of factors have all combined in having a dramatic impact on the ways we work – and lead our working and private lives. Much of this continues to unfold and looks likely to continue for some time – but not necessarily in a linear way.

Working Free contends that about 40% of the UK workforce (Total in Employment) are Atypical Workers. For a Government that declares itself as wanting to work with ALL the talents, here is a large group of the working population that they need to integrate into the workforce albeit on their terms.

The Working Free approach to the Government’s Transformation Programme is reflected in these points: –

- There are not enough people in the workforce – and certainly not enough for the likely needs of Invest 2035:

- About 40% of the Total in Employment in the UK can be categorised as Atypical Workers – being everything except FTEs (Full Time Workers.)

- What has this got to do with Growth?

- Invest 2035: – and all the other Government documents – look long -term and expensive – What we must have – NOW – are some quick wins and major communications programmes. This is everyone’s project. Everyone is paying for it.

- Intervention – the elephant in the room.

Is there a crisis around People in the Workplace? It’s certainly time to treat differently those Workers who want to be treated differently.

Understanding and reacting to these points consists largely of variables interacting with variables and is something to be seen as an advantage rather than an impediment.

Traditional views on managing, directing and regulating relationships in the workplace are moving towards collaborating, connecting, sharing and partnering. Working Free is keen to promote any talk about any or all of these issues through collaborative arrangements with people-centric progressive organisations, adapting to a changing world.

Seeing this as an idealistic – even simplistic – goal might appeal to many. But a recession or similar conditions will likely lay bare harsh sentiments.

Corporate instincts are based on preserving the cash. Under threat, the first step is to fire people. Government action to date – changes to NI, Minimum wages, new Employment rights, gloomy Government pronouncements, unhappy farmers and the knee-capping of independent schools all damage confidence and employers revert to traditional behaviours.

Invest 2035: must be an ideal opportunity for Government to reset all these inherited notions.

These are the soft characteristics behind the growth in Atypical Working

- Virtually instantaneous communications – in many forms.

- a resetting of the Employer/Employee relationship.

- a rethinking of the work/life balance philosophy.

- replacing line-of-sight management with trust – and education.

- the upending of the meaning of friendships.

- learning how to reconcile new concepts of individualism with collaboration and team-work – and short-term needs with longer-term relationships.

These ideals deserve to succeed. But if recession-type conditions promote the opposite, the UK will be the loser.

Exploring the full role of people within the context of the Government’s Transformation Programme is a fundamental.

The Government has defined the Product. The task now is to implement it. And that needs people – importantly Boots on the Ground – and all this needs Process! This means exploring Product and Process – what people have to do and how they do it.

Working Free is a niche concept on an old theme. It’s about how people – particularly senior and similar management levels can re-invent themselves – usually after a mainstream career or responding to shifts in technologies, markets and existing and development sentiments but not necessarily – and, in this context, as an Independent Professionals.

Working Free supports the middle to senior executive considering embarking on a new career as an independent professional. We work with Individuals directly and with Organisations as part of restructuring, redundancy, outplacement, career development or other mid-career transitioning arrangements and where independent working at middle and senior levels is seen as an attractive way forward for themselves and for their organisations

More info at www.WorkingFree.co.uk

The WorkingFree Approach >>>

The Working Free Approach

Sections

Section 1 – Getting Started

- Introduction

- Understanding the statistics

- Definitions

- The role of Unions

Section 2 – Public Sector and Private Sector

- Facts and Figures

- How do we measure how many workers could be categorised as Public Sector?

- What do the numbers actually mean?

Section 3 – Atypical Workers

- What are Atypical Workers?

- What is it?

- Why does it need changing?

- An IR35 Solution – The Working Free Proposal

Section 4 – What has this got to do with Growth?

- What has growth to do with Working Free?

- About the hysteria

- Have the right targets been identified?

- Growth means new money

- New money means exports.

- What to focus on? The key question

Section 5 – Why does any of this matter?

- More about Business; less about dogma

- A philosophy

- Flexible Working

- WFH (Working from Home)

Section 6 – There are not enough people to do the work

Section 7 – What do we do now?

- Time to think differently

- A big-scale Programme calls for a big-scale communications response.

- How best to communicate?

- Merging bits of public sector operationally with private sector.

- Treat Atypical Workers as equal to any other worker – and let them do it their way.

- Don’t mention the word ”Growth” again!

- Tell the Unions the true story about Zero Hours Work – see below – and tell them you want more.

- Stop bumping into bollards.

Section 8 – Parting Shots

Section 9 – More about Working Free

Postscript 1 – Lessons from History

Postscript 2 – About Interventions – the Elephant in the Room

Postscript 3 – Finishing where we started

Section 1 – Getting Started >>>

Section 1 Getting started

Introduction

The last few years have seen big changes in the workplace and within the workforce. – and with all needing to survive and prosper in a volatile and highly competitive socio- economic global market. We have a new Government styling itself as dynamic, radical and Transformation-driven – but which, sadly, has knocked over a few bollards as it runs itself in and comes up to speed. But their Invest 2035: and the rest of their current collection looks like it could be the right approach at the right time – assuming they can deliver on their initial promises – on time and on budget.

Working Free’s core driving belief is that the UK’s working population of now about 33mn is heading towards parity between purely FTEs (Full Time Employed) and Atypical Workers – nearly all off-payroll workers. Whatever anyone thinks – or calculates different figures – it is difficult to ignore this major structural change.

The overall Project will call for experienced, skilled, driven, and entrepreneurial people on the ground in making this Project work in a sustainable way. Who are these people? Where do these people come from? How are these people mobilised?

In some ways, their Invest 2035: Green Paper could be seen as an antidote to their lack of detail in their Manifesto, a response to their Autumn Budget and to their current Employment Bill and in particular, the NI component. And more that is to come.

It is reasonable to suppose that Government – and any modern Government – cannot, in practice, impose more taxation on businesses without giving them the enabling tools to cover their costs and grow. Otherwise, it is simply wealth redistribution. Of little interest, of course, to those with NO wealth who usually vote Labour

The Victorian Industrial Revolution was mainly self-driven. Invest 2035: needs to recognise this and create their Programme around it.

Getting this Project right and delivered soonest might be more important than many would suppose.

- Does anyone actually know what Growth means? Exactly what are you selling to whom? How do you increase sales and margins and get better value for money out of your costs? Invest 2035: asks these questions. Crucial to find the right answers. Surely this is what people do; not Governments. Working Free offers their own definition of Growth in Section 4

- Probably there are not enough People in the UK workforce to make this overall strategy actually work. A problem to be solved. This Paper addresses this issue.

- After creating an effective Industrial Strategic Plan, does Government know how to translate theory into practice? Projects of this scale invariably have poor delivery records. This project will be all about Products and People. The Government says it can handle the Product bit but Working Free says they are much adrift with the People bit. Mostly it is people who make things happen on the ground. The Government acknowledges the issue of skills but is relatively silent about people and equipping them better to meet the challenges that the new strategies will call for.

- The current FTE workforce of 22mn cannot be reasonably expected to support a population of 69mn with an average age of 40.7 and a growth rate of 0.85%. (The impact of immigration may not yet have been fully reflected in ONS figures.) But there is more to it. Read on!

Understanding the statistics

The starting point (see ONS EMP01) has to be the ONS Employment statistics.

The role of the ONS (Office of National Statistics.)

The ONS is the primary source of all data connected with the UK. What they have been doing and developing is on a massive and technically impregnable basis. Virtually everything else is derived from what they do.

In the middle of 2023 it emerged that some of the emerging stats looked irregular and new conditions started to become visible. The ONS was not sure when this started. Irregular stats also became noticeable and were backed by the realisation that the ONS Labour Force Survey figures had now become reliant of a survey response rate down from 50% to 15%. This triggered alarm bells. To experts at the ONS, there will have been a gutfeel that some things did not simply feel right.

Other issues came into better focus. For example, was the ONS measuring some things that had changed fundamentally and was their sample still as representative as when they last amended it. Working Free’s concern was around their version of Atypical Working and also how the Survey Respondents interpreted and answered – if at all – the standard questions asked as against the major changes going on.

This is all difficult stuff.

You can read the ONS’s commentary on this at – google ONS EMP01. And elsewhere.

With the total of 33mn in the total active UK workforce being the major component, this is broadly how the overall UK populationfigure breaks down into its constituent parts: –

| Total in Employment (ONS Emp01) | 33,770 |

| Unemployed (4.3%) (See Note below) | 1,508 |

| Worklessness/ Economic inactivity. (21.7%) | 9,337 |

| Pensioners/ Retired over 65 | 11.000 |

| Under 14’s (From the last census) | 11,524 |

| Total (Actual UK current Population is 69mn) | 67,139mn |

What this says is that, broadly the UK only has about 33,770mn people in the workforce. Working Free contends that 40% of this are Atypical Workers – inferring that many of this number are invisible to Government.

Also needing to be taken into account are public sector workers who are generally seen as back-office people and not customer-facing – but still important. Currently quoted as 5.9mn. (Now quoted as 6.12mn.)

More scrutiny of this follows.

The difference between the current actual UK population of 69mn and 67mn – above – is due to some selectivity, simply not having the current means to get at the base facts and/or collective immateriality. Much of this happened gradually until Covid and then more quickly.

Something you might like to reflect on: – and in particular, the way in which the Unemployment Rate is calculated: – (see main points above)

Unemployed – 1,508 – (4.3%). This is 1508 x 100 divided by Total in Employment – 33,770 plus 1508 = 35,278.

Working Free suggests that the main figure to be used should not be the Total in Employment but the figure for FTEs (Full time employees) as unemployed comes out of this figure and us unconnected with all the other figures adding up to the Total in employment.

This makes the revised figure – This is 1508 x 100 divided by FTE 22,269 plus 1508 = 23,777 = 6.3%

If you approve of this approach, you should be concerned about it!

Definitions

- Total in Employment

- The Unemployed

- Unemployment

- The DWP Claimant Count

- Worklessness

- Economic Inactivity and

- The Self Employed. It’s a chimera.

Total in Employment

…….. is the actual number of individual workers currently active in the workforce irrespective of working status.

The Unemployed ….. calculated and shown separately but not in “Total in Employment” the above.

Unemployment

…..is when an individual who is not employed and is seeking employment, cannot find a job. Traditionally, unemployment is a key indicator of the health of an economy. A low unemployment rate represents a strong economy while a high unemployment rate represents a weak economy.

The ONS is the source of this data – collected through the Labour Force Survey, the responses to which are self-assessed. (More about this elsewhere in this Paper.) Claimants are invariably those who want the money – and maybe claim other benefits linked to being unemployed.

Many others who are technically unemployed do not claim nor register as unemployed. It will not be known – from any source- how many fall into this category. Working Free estimates that this is likely to the majority of the higher salaried people.

Some might disagree with this – taking the view that Covid and its ripple effects have had a different sort of impact – in that being ill could not have been avoided – nor recovery from illness have been a quick process. Also, many individuals – particularly those who could now afford to do so – have chosen to adopt a different and a non-work lifestyle. No-one really knows how many of these will return to the workplace. Nor what they will do when they do return. Times have changed.

When these people have recovered from whatever shock, surprise, disappointment will have surrounded the manner of their leaving. They will start to think hard about options in theory. This should start with a broad view of what these options might be – talking confidentially and while lay with family, professional advisers, mates and Friends deemed to have anything serious to say on this matter.

Increasingly the answer is going to be look for a similar role to the one just vacated but – importantly – in the meantime cost abroad net on various options and get doing something as quickly as possible – whatever that might be. For the main part, designating yourself as a consultant – however defined and however described – and getting to meet people and generate ideas.

At this stage they would describe themselves as self-employment self-employed and if they were picked up on any statistical process would describe themselves as such. This process will see them included in the ONS category self-employed.

Self-employment is a very Broadchurch. Unemployment is probably understated.

The DWP Claimant Count

The Department for Work and Pensions (DWP) claimant count is the number of people who are claiming unemployment-related benefits, including Jobseeker’s Allowance and Universal Credit. The DWP claimant count is an administrative measure that uses individual records from the benefit system.

In October 2024 this was 1.769mn – an increase of 210k over the previous year.

The official figure is the ONS Claimant Count which should not be seen as a figure reconcilable with the quoted DWP figure.

Worklessness

This is a fairly new definition for a fairly new phenomenon due to its size and covers several conditions – and has been estimated, for some time, at 9.4mn.

Worklessness is a state where no one in a household aged 16 and over is in employment, either through unemployment or economic inactivity.

“Worklessness” is a term that refers to people who are not currently employed, have not sought employment in the last four weeks, and are unable to start work within the next two weeks. It can also refer to households where no one aged 16 or older is in employment.

Worklessness is different from unemployment, even though there are multiple definitions of worklessness. For example, people who are caring for children or family members may be considered workless, but they would not be included in unemployment figures. They don’t generally get paid for this work – but if they did not do it, the state would have to pay.

Some reasons why people may be economically inactive include: family commitments, early retirement, study, sickness, and disability. The ONS offer analyses on these figures.

The Institute of Employment Studies, (www.employment-studies.co.uk)

for example, has presented a bleak picture of how the absence of 9.4 million workers (broadly described) has resulted in a major obstacle to any sort of growth and describe it like this:- a larger contraction in the labour force than in any Parliament since at least the early 1970s.

A worrying number of young people feature here.

Working Free sees this as a vital and complex ingredient for the future.

But not for this Occasional Paper. Too big a topic.

It is doubtful that many of the ill ones will return and many of the others are too comfortable with where they have got to during and after covid.

Many have restructured their personal finances (including those who might have still got some furlough money saved up) and can’t, in any case, leave their homes for too long as they have now got a dog! (Not a joke! People think differently about life and work post Covid).

Continuing inflation may give them difficult decisions to make.

What you don’t find in many commentaries

(which tend to be hijacked by WFH debates – which are fascinating to watch – is that initial reactions to the missing workers post-covid (for all reasons). This triggered a focus on digital solutions – technology backfilling the empty spaces. This negatively impacted on customer service levels, and which now seem to be improving. (What happened to “excellence”?)

The passing of time will exacerbate this gap between what needs to be done and the ability of former employees to handle them. These people will increasingly find that they have lost their “distinctive competence” – skill-sets – and, in particular, their IT skills have fallen behind. As will, in many cases, their interpersonal skills.

Now, a commute has changed from a routine into a special trip.

Those who took advantage of WFH to relocate further from their workplace (which still should be supported and accommodated) will also now have difficult issues to manage.

Economic inactivity

A state where someone is neither employed nor unemployed and is not looking for work.

The main difference between Economic inactivity and Worklessness is that someone who is unemployed is looking for work, while someone who is economically inactive is not.

Included in Worklessness/ Economic Inactivity – 9,337mn are reported as:

Caring responsibilities 1,100 (aged 25-49)

Illness 1.000(aged 25- 49)

Early retirement 3,500 (aged 50-65)

ONS reported illness as 2.5mn at August 2022; 2.9mn at March 2024 but with some modest improvement since then

Self-Employment (is a Chimera)

But before exploring this in a head -on way, there are side issues that are very relevant – some of which arise in different sections in this Paper.

These preliminary comments include those self-employed professionals offering personal professional services.

ONS reports that there are 2,944mn full time and 1,439mn part time self-employed workers in the UK. Total is 4,383.

This figure is misleading. As well as the reasons mentioned below, the interpretational and collection of data difficulties, the much-written-about plight of the “over 50s” (55 to 64 range) there is a broader key issue with many workers aged 45 to 65. This varies slightly between management levels but of significance to the purpose of this Paper – the focus is on middle and senior levels.

This is noticeable as a general trend but more so as the economy tightens. The Trump effect will exacerbate this as will the ever-present need for the UK to start making a profit.

More middle and senior level workers are being squeezed out of permanent employment and – for a variety of reasons – become invisible. Many of them “drift” towards “doing their own thing.” The only statistic they might appear on are as “economically inactive”. But the nature of what they do is largely unobserved.

You can see them on LinkedIn – gone off looking for a job like they used to have – even though they know that these have gone ; now selling various forms of Consultancy; hoping for some Non-Executive Director work… etc.

Look at the approx. 170 MPs displaced after the General Election. Listen to what they say. And then interpret it.

Government seems unaware of this dereliction of talent. This Transformation Programme must cover this.

Finding ways of sending them around the world flogging the Government’s eight Target Sectors would be a good idea.

“Self-employed means being employed by yourself.”

This is Working Free’s definition. If you conduct a search, you’ll find literally scores of definitions. Virtually all of them differ slightly but all of them are heavily mindful – even wary – of the tax implications. It’s almost as if the tax implications are the sole and only things that matter.

Whereas, what actually matters is having a professional product, being good at it and being able to sell its services to happy and grateful clients and in accordance with relevant legislation.

It is when your own business model differs to this that problems arise – mainly along these lines:

“If it looks like a duck and if it waddles and if it quacks, it is highly probable that it is a duck.”

Please see our comments on IR35 in Section 3 – Atypical Working

Broadly, this is how HMRC is guided through its IR35 legislation. Where this applies, Self-employed Workers are taxed at source – along PAYE lines. But defining rules around this is difficult.

This usually involves accepting a short-term Employment Contract, invariably on less favourable terms than full time permanent staff, waiting longer to be paid through an intermediary and with deductions than can be as high as 50%.

Please see our comments on Umbrella Companies in Section 3 – Atypical Working.

Otherwise – and this is where Self-employed workers fall outside the scope of IR35 – they are treated and taxed as a small business in its various formats. These people are the undervalued and under-recognised part of the UK workforce.

IR35 is an unsatisfactory tax and needs to be re-drafted.

This overall area is a kaleidoscope! Variables interact with variables.

The Unemployed; Worklessness; Economic Inactivity – all workers falling in these categories may drift in and out of Self-employment.

We tend to think that self-employed people are those offering their personal professional services for whoever wants to buy them and trade through their own personal service company (PSC)

There are probably just as many self-employed people doing other things outside this definition – such as running small shops plumbers, electricians, painters and decorators ,car mechanics and micro businesses including an assortment of manufacturing or assembly operations. As part of this thinking are also the undeclared workers – including domestic cleaners and gardeners, plumbers and electricians and carpenters and similar – all working for cash to varying extents.

Some FTEs have a second job. (This must be relevant as the ONS treat this as worth a separate mention in its monthly statistics. At the senior end it will include areas like NEDs, Charities, secondments, special agreements with main employer, ad hoc advisory work that may turn into something bigger. etc.

At the lower end, it might include evening shifts in pubs, third party events stewarding, accounting/admin support for SMEs, “night school “and other learnings, baby-sitting, etc.

At lower levels than this will be the domestic workers – cleaners, handymen and gardeners. Perhaps unfairly included in the definition of the black economy.

The black economy …

is defined as all economic activity in a given economy that occurs outside or in violation of the prevailing laws and regulations of society. People will break or ignore the rules imposed when governments intervene, tax, or regulate markets. Broadly assessed by observers as worth £150bn per annum.

Temps are reported separately and are not included in these mainstream ONS Total in Employment figure. Working Free views these figures as needing to be treated as Atypical workers and are actually in the workforce.

Also needing to be borne in mind are agency workers and outsourced services.

At what point does an individual cease to be a self-employed worker and be seen as a director/owner of a business and therefore seen as full-time employee of a company/business – which he or she actually owns? Is Dyson categorised as self-employed as he owns most of his company?

Slightly different than this would be, for example, equity partners in the large accountancy-based consultants these people are categorised as self-employed although operating on special rules and understandings with the HMRC.

These are the Employment figures. There are more recent figures from ONS EMP01– but they don’t move the percentages.

| All Figures | NOT f/t Employed | |

| Million | ||

| Employees (Full-time) | 22269 | 6933 |

| Employees (Part time) | 6933 | |

| Self Employed (Full time) | 2944 | 2944 |

| Self Employed (Part time | 1439 | 1439 |

| Unpaid family | 116 | 116 |

| Govt Support | 65 | 65 |

| Total in Employment | 33,770 | 11,497 |

|

33.9% |

However, Working Free would also contend that Employees, full time but with a 2nd job of 1,256 and Temps of 1,538 need to be taken into account.

Working Free contends that 33.9% – say 34% – now as 40.2% represent the atypical working part of the UK Workforce . ONS defines part-time work as 30 hours or fewer per week. However, there is no specific number of hours that makes someone full or part-time. Working Free treats part-time workers as Atypical Workers.

We are sure that the ONS would recognise the 34% if asked – and possibly the 40% – but may express some surprise about what third parties do with their figures!

The role of Unions

The Trade Union Movement and the Labour Party were joined at birth.

It will be interesting to see what sort of accommodation will be forged that will see Invest 2035: succeed as eventually planned and the Trade Union Movement able to share the credit for that.

- In 2023, there were 6.4 million trade union members in the UK, which is an increase of 89,000 from the previous year but still 131,000 fewer than in 2020.

- Trade union membership has been declining for the past four decades, but the rate of decline has slowed. Membership peaked in 1979 at 13.2 million and then declined sharply in the 1980s and early 1990s.

- In 2023, there were 2.5mn in the private sector and 3.8mn in the public sector.The trend seems to be difficult to forecast. Current growth in the Public Sector would point to an increase but if more jobs are moving more towards knowledge workers, that might point otherwise. As the UK employment profile shifts towards Atypical Working and increasing numbers of workers are needing to become more technology savvy and more qualified, Union membership may well become less attractive to both companies and to individuals

The original purpose of Unions is to prevent exploitation and abuse in the workplace. This will become more important but occurring less frequently. The everyday purpose continues to be about money, hours and conditions.

The ghost of Red Robbo and British Leyland may come back occasionally to haunt some – where a toxic mix of truculent unions and incompetent management heralded the end of indigenous car manufacturing in the UK.

Not dissimilar to this was the demise of coal mining where the ghost was of a different nature – the desecration of job-futures and communities that left many scars still visible today.

Of concern to Unions will likely be that most of the targeted sectors call for clever, mobile, higher-educated people with a good knowledge of their sector technology. The more there is of this, the more successful these people and their businesses will likely be.

The future lies in the degree of positive interactivity between Government and Unions. It would be a good look if Unions could get behind Invest 2035: If only because they, as UK citizens, are helping to pay for it.

Notwithstanding this, the Unions’ key focus will need to adapt more towards the need to retrain and repurpose their members. What might augment this process is to see it on a much broader Training and Education base.

Additionally, the contentious enlargement of Public Sector would work to the Unions’ advantage.

More information from the Dept for Industry and Trade

www.gov.uk/government/organisations/department-of-trade-and-industr

“O that we now had here but one 10,000 of those men in England that do no work today.”

According to Shakespeare, this is what the Earl of Westmoreland said to King Henry Five on the night before the battle of Agincourt. This might have reflected the degree of Worklessness current at that time in England – but Henry felt obliged to put right Westmoreland and the others gathered round – and delivered his famous feast of Saint Crispian Day speech. Agincourt was a Victory. it is estimated that English losses amounted to about 400 and French losses to about 6,000, many of whom were noblemen.

Section 2 – Public & Private Sector >>>

Section 2 Public Sector and Private Sector

- Why differentiation is important

- Facts and Figures

- How do we measure how many workers could be categorised as Public Sector?

- What do the numbers mean for Costs and Value for Money

- Intervention – See Postscript 2

Why differentiation is important

In order to assess the figure of the available workers to directly create and support the generation of national wealth, we do need to assess Public Sector workers as to their role in national wealth creation.

Generally, Public Sector workers do not directly contribute to the creation and delivery of goods or services. although a big element of some of their work provides good back-up and support– particularly from the Department for Business & Trade and, operationally, the Foreign, Commonwealth and Development Office. DCMS has eventually been revealed and/or recognised as a key activist behind the UK Creative Industries Sectors – a key part of the UK being the second biggest exporter in the world – of services.

Maybe, these people can be referred to as Non-Productive as opposed to Productive – or Back Office as opposed to Front Office. It’s a bit like Armies without their back-up; fighter jects without their engineers and tech support; the US Abrams Tank without its retinue of tech support.

In all of this, the aim is to get to the stage of maximum number of workers at the customer interface.

Many observers would take the view that Public Sector also needs to include those people who are actually paid for by Government – part of the Government envelope – but NOT FTE on the Government payroll.

More about this elsewhere in this Section and Paper. Not an easy assessment.

Additionally, Definitions are an issue. These can be fairly complex issues. Primarily, these are about data collection processes but also about changing definitions and major changes by Government in how the various components are aggregated and displayed. (eg: The employees of railway businesses who have passed into Government ownership become Government employees for the duration.)

The reality is that this is where the UK is at the moment. Surely the UK needs less back-office people and lots more front office people?

It’s all about Products, People and Process. The Government has (just about) decided what the Products are. Success in their Transformation Programme will be largely down to People – and we don’t hear much about the People involved yet and, partly because of this, we don’t have Process outlined.

Government is not quite sure how to sort out the people component but is active. The reality is probably about Intervention – more or less direct control – micro-management or laissez-faire. Their task should really about creating opportunities – more about work; less about jobs. BUT…… whoever owns the Project is responsible for making it happen – and the way the new Trump world is shaping up, the less time we have for getting this job done.

Forget about dogma. Just get the job done

Facts and Figures

The Reporting Convention seems to be that Public Sector and NHS are reported separately. Some commentaries do not make this clear.

ONS reports that the UK Public Sector employs 6.120mn people and this is 18% of the Total in Employment: –

Public Sector 6.120mn 18%

NHS 2.040mn 6.04%

Private Sector 25.610mn 75.84%

Total in Employment 33.770mn 100%

Public Sector (Central Government, Local Government and Public Corporations) and NHS is 24% and Private Sector is 76%

Working Free contends that the real figure for workers supported by Government money – but not actually categorised asEmployees – is considerably more than this. It is difficult to be precise about this due to availability of data and a blurring of interpretations.

But in 2023, for example, the NIESR suggested that a figure of 10.6mn was more likely than 6.1% This would have changed the percentage split to 37%/63%

Public Sector employees have risen since then. Working Free reports below that in the last year, they have increased by 170k.

From the ONS published information (try googling – ONS EMP01), this is the latest Current Position – as at end of September 2024 – published on 17.12.24. (Next issue 20.3.25)

- Employment in central government was a record high at an estimated 3.97 million in September 2024, an increase of 28,000 (0.7%) compared with June 2024 and an increase of 113,000 (2.9%) compared with September 2023; the main contributors to this increase were the NHS, some local authority schools becoming academies, and the Civil Service.

- The NHS employed an estimated record high of 2.04 million people in September 2024, an increase of 12,000 (0.6%) compared with June 2024 and an increase of 57,000 (2.9%) compared with September 2023.

- Employment in public corporations was an estimated 157,000 in September 2024, an increase of 4,000 (2.6%) compared with June 2024, but a decrease of 39,000 (19.9%) compared with September 2023; part of the annual decrease is impacted by a reclassification between March 2024 and June 2024.

- Employment in local government was an estimated 1.99 million in September 2024, a decrease of 6,000 (0.3%) compared with June 2024 and a decrease of 11,000 (0.6%) compared with September 2023; some local authority schools becoming academies contributed to this decrease.

- There were 548,000 employees in the Civil Service in September 2024, an increase of 2,000 (0.4%) compared with June 2024 and an increase of 19,000 (3.6%) compared with September 2023.

Latest figures – above – can be summarised as follows: –

| increase -1yr | ||

| (Million) | (£’000) | |

| Central government | 3.970 | 113 |

| Local Government | 1.990 | (11) |

| Public corporations | 0.157 | (39) |

| Total – Described by ONS

|

||

| as Public Sector | 6.120 | 63 |

| NHS | 2.040 | 57 |

| Total – Public Sector Workers and NHS | 8.160 | 120 |

Note: Central Government includes 548,000 Civil Servants – being a 19k – 1 year increase.

Current statistics are specifically restricted to Government employees. Some are employees through a separate entity (eg: Public Corporations)

The year-on-year net increases add up to 120k. If you exclude the two minus figures this becomes 170k.

Of the two minus figures, Local Government run their own show within constraints and some funding from Government and noisy commentaries from their local citizens. There is also a level of estimation in these figures. The minus figure in Public Corporations is in practical terms outside Government direct action.

Whether this 170k is seen as a big figure or a modest increase is a judgement waiting to be made.

This is how Public Sector is defined.

- Central government includes Government Departments and their ALBs (Arms Length Bodies) : Executive Agencies, Non-Departmental Public Bodies, Non Ministerial Departments, and any other non-market bodies controlled by Government

- NHS is treated as a separate organisation.

- Public corporations: There are quite a lot of them. Within this category, there is an in and out flow of organisations reflecting circumstances. A public corporation is a company that is owned and managed by the government but operates independently from government departments. Public corporations are accountable to Parliament for their activities and are usually funded by taxpayers.

See- assets.publishing.service.gov.uk/media/5a7cc87be5274a2f304f00c7/pesa_2011_chapter8.pdf

(NOTE: The Post Office falls into this category, reporting to the Secretary of State of Business and Trade. Many might suppose that the governance issues experienced by the Post Office – as opposed to technology-based problems – may well exist elsewhere in this overall group.)

How do we measure how many workers could be categorised as Public Sector?

Public Sector really needs to include – in addition to “employees” – those people who are supported directly by Government money.

- Government money finds its way into a range of suppliers and outsourcer businesses – not employed or contractors – but otherwise delivering goods or services to Government.

- The figure should include government contractors such as cleaners and security guards. While they might not technically be employed by government they are nevertheless funded by the taxpayer and working for the state and also, mostly, working to the same terms and conditions as would apply to direct employees of government. This can be a sensitive issue- in other contexts.

- Organisations on preferred supplier lists, frameworks and otherwise under contract.

- Suppliers to the above.

- Direct procurement engagements. Not usual but needs to respond to emergencies. (Happened fairly often in Covid.)

The aim is to calculate exactly how many workers in the UK are available to generate national wealth as part of the National Transformation Programme.

Excluded, obviously, is money that constitutes investment, funding, grants and loans, much of which will trickle down through third parties. The Conservative Party’s unavoidable Covid spend of £440bn which, in the end, will not be discredited, Is obviously But it will be a long time before the damage has been made good – if ever.

An interesting case-study example could be the Big Four accountancy-based Consultancies.

As a major part of their income comes from public sector work and, together with their FTSE 100 (and a bit beyond), clients, they have a fine and remunerative business model. The Covid years disrupted this. When Covid fell away, their staffing process had to react reflecting less Government work and many Big Four employees were let go. But this will doubtless recover. In fact, it now looks as if some recovery is under way for the Big Four in Government work – in spite of their strong rhetoric about anti-consultancy spend.

The debate here is whether these people should be seen as employees. Technically not, but indirectly they might be. Do they provide a service that otherwise would be needed on the payroll. Of course, expert external advice may well be needed by any organisation. But, all of it? Clever, well-educated senior public servants ought to be able to make up their own minds. But off-loading risk and responsibility is an easy thing to do.

Translating this into cost is an interesting exercise…….

What do the numbers of people mean for Costs and Value for Money

A primitive – maybe clumsy – way of approaching this might be to pick up from the internet this quote from the Institute of Fiscal Studies

26 Sept 2024 — The public sector employs 5.9 million people (as it was then) in the UK, at an annual cost of £270 billion in 2023–24 (including salaries, employer pension.)

This is £45,763 per person. Some may see this as on the low side – but Public Sector does employ a very broad spread of people.)

Based on this, for the latest reported figure of 6.12mn – the pro rata increase would be £14bn extra to £284bn

And if it were 10.6mn, the pro rata increase would be a whopping £209bn – making £493bn.

Who is to say what the real figure for Public Sector numbers and costs might be?

This is why the UK has to move into profit. It needs to do it through the Government’s National Transformation Programme. The UK, as a country, last made a profit in 1997 (except for an accidental profit in 2020) and in only 18 years out of the last 76 years since these records began in 1948 during the Labour Government of 1945 to 1951

The immediate future is going to be – and it looks like it has already started – about doing a lot more with no extra money to do it with. The urgency to get hold of new money has to come from foreigners and be earned.

Section 3 – Atypical Workers >>>

Section 3 – Atypical Workers

- What are Atypical Workers?

- What is it?

- Why does it need changing?

- The Working Free Proposal. A solution!

What are Atypical Workers?

Workers at all levels other than FTEs and operating on an individual basis and but generally independent basis and otherwise describing themselves as Self Employed have become a more significant element in the UK Employment Model, changing the word employment for engagement.

Working Free contends that Atypical Workers will represent about half of the UK’s working population in the future. – and are well on the way now.

Atypical Workers are a varied and mixed group of: –

GigWorkers, Part-timers, Self-employed, Contractors, Freelancers, Interim Managers, Temps, Consultants, Management Consultants, Semi-retired people, Portfolio Workers, Off-payroll workers, Self Drive Workers, etc.

(Portfolio Workers include a broad mix of Professionals who have more than one source of income and work-type activity (whether on the payroll, freelance or non-remunerated – or a mix of these.)

Additional features that muddy the waters include: –

- Equity Partners in professional Practices are almost entirely categorised as Self Employed but, to many do not appear as such. Special arrangements with HMRC are in place in many cases.

- Many individuals who are Directors of their own one-person limited companies are seen by HMRC as Self Employed but describe themselves as Full Time employees of their companies. (Usually PSCs – Personal Service Companies.)

- As the ONS base their figures (Labour Force Survey) on a huge sample, they were not able (and this is what they said) to take fully into account the impacts of Covid.

(An example of this would be that for a period of time there were 9m – virtually all of them FTEs – on furlough. Not allowed to work! But still included in the ONS stats as FTEs.)

- The rights someone has at work whether they are entitled to redundancy pay or are protected against unfair dismissal – are dependent on whether they are an employee, a worker or self-employed. (These three categories look like being reduced to two.)In these circumstances, Atypical Workers are often disadvantaged.

- Employment status is not defined clearly in law and the definitions used for tax purposes can vary from those used for employment rights. The growth in the gig economy has given rise to many claims for the rights of ‘workers’, such as the right to receive the National Minimum Wage and paid holidays, for gig workers who have been defined by the organisations they work for as ‘self-employed’.

- On the fringes of all this are many part-timers who allocate all or some of their time to caring for children, grandchildren, other family members, the needy and/or the sick– and quite often taking on some charitable work.If they did not do this, the state would have to pay for it. Alongside this, however, there are reports that “volunteering” and/or “joining” levels have reduced since Covid., although some think that this is temporary. This will have put pressure on the state to fill the void and pay.

What is of current interest is how many of the MPs put out of work at the last General Election are now “Atypical Workers”? Actually, no-one knows. But networking conversations suggest a range of current incomplete discussions still going on and, in some cases, not having a good understanding of how Atypical work operates. NED work seems elusive to those expecting it to be a given.

- About 40% of the Total in Employment in the UK can be categorised as Atypical Workers.

- Atypical Workers are almost all off-payroll but included in the 33mn. This means that virtually all never get counted in any Unemployment figures.

- This means that when the economy downturns, they are the first to feel it. (It is the difference between Jobs and Work). It puts Atypical Workers in the same category as the rest of the economy selling to consumers and to other businesses selling to consumers.

- But what also happens is that the FTEs who are reacting to being made redundant may well conclude that there are no available FTE positions for them elsewhere and, amongst identified options, will turn to Independent Working as a personal solution. At this stage they will recognise the big diierence between JOBS and WORK. See Section 6.

IR35 What is it?

IR35 is a troublesome and unnecessary tax aimed at independent/ self-employed workers where HMRC deem that they do not meet the statutory employment status criteria and, thereby, recognised as an Independent Business supported by Contract Law and not Employment Law and be accountable for their own tax liabilities.

One of the impacts of IR35 is that a significant number of “Independent Workers” have found their way unwillingly on to a corporate payroll and are treated as permanent employees but, sadly, without the full range of benefits. One of the results of this is that some independent workers will be counted as FTEs.

In recent times, employers have also mandated inclusion on their own payroll for fear of HMRC penalties.

Referred to by many as “bogus employment” with strong echoes of “tax dodging”, these are difficult distinctions. In practical terms, the fact that workers who WANT to be treated as independent practitioners have no standing ought to have an alternative. Working Free offers their solution. Read on!

Does it matter?

But these people do have other choices faced with redundancies – and we all know something about all of these. They can quit altogether – money and options permitting — retire” of go off sick. They do become largely invisible and have to learn new tricks. Largely on their own. Government is not interested if they can’t see them – but supports HMRC who are inclined to see them as tax dodgers whilst Unions are likely to see them as zero-hour workers.

How an absence of work – and the jobs that would flow from that – play out in practice depends on the level of worker. At the lower end, there are about three financial support options. At the more senior end there is probably nothing by way of support.

If anyone in Government would value a closer look at this, talk with some of the MPs who lost their seats last year. This might be you in 2029!

IR35. Why does it need changing?

Because the world is changing and more workers – particularly at senior levels – understandably want these changes to be recognised. Many others share this view. And this will have more credence as the economy tightens. (This view expressed Feb 2025)

See it this way. Compare the plethora of employment legislation coming into law and unusual disruptions with a tightening economy where there is less work around and redundancies will start to increase.

Lots of effort for workers who are NOT there!

More workers moving, in effect, from corporate payrolls onto the Government’s payroll.

The Government’s journey towards their vision of the UK’s future really does need to avoid colliding with these bollards!

Umbrella companies

Umbrella companies are a fairly new phenomenon in the employment market and have been independently created to respond to the new rules – from 2020/2021 – to facilitate tax collection under the IR35 legislation.

There are – reportedly – about 500 of these specialist operators in the UK and their purpose is to assess and collect PAYE and NI from the Independent Workers who fall within scope of IR35, pay it over to the HMRC and invoice the organisation hiring the independent worker with the full (gross) amount. The umbrella market is unregulated, and umbrella companies are just standard limited companies operating payroll services.

At the start of any assignment between an organisation and an independent professional, their tax status has to be established and there is HMRC published criteria upon which the determination can be based. Many see this as overly subjective – and it is primarily the workers’ decision. The financial risk of getting this wrong can be distinctly punitive – both for the worker and the client organisation involved. What happens in practice is that the client automatically elects to use am umbrella company for all workers engaged in this way.

Statistical data for the size and volume of this process is hard to come by but the sector itself offers various assessments of the number of independent workers Operating through them Industry sources generally assess this at 700,000 (2024/5) and HMRC itself is reported as agreeing with this.

The impact of this is that whatever the number is , these workers are whereas in fact included in the full-time employee (FTE) figures in the ONS statistics. – the individuals concerned see themselves as at running their own small business andthe reality is that they are self-employed and should be included in this category in the ONS statistics.

Nevertheless, Independent Professionals working through Umbrella Companies doing established payroll jobs should be treated as FTEs as currently required. But they should enjoy the same benefits.

But the question should be asked “Why does the company not recruit permanents (FTEs)to do the work?

The negative answer would be they can’t find any. Why not? Because they don’t exist. ONS and the Government confirms that.

But you can find Independent Professionals – seven hundred thousand of them. And you engage some of them because they have more to offer; or suit better your timescales and/or requirements; or you don’t want to employ FTEs because they are too much trouble. Contract law is very much easier that Employment Law – particularly the new ones.

So, something is wrong somewhere.

Here is Working Free’s solution

IR35. Working Free’s Solution

Instead of arguing about tax – which are very much problems waiting to be solved, HMRC – and the Government – should adopt a much bolder – maybe radical – approach and implement Working Free’s long-standing proposal as a solution.

The Working Free Proposal is around creating a different and new form of Limited Company with some alterations to detail and following the VAT operational model.

Read Working Free’s long-standing Proposal for a better system – below.

The Working Free IR35 Proposal

The government should create a new type of limited company which any independent worker, domiciled in the UK, may set up and trade through. Normal rules for limited companies apply except that this type is forbidden to pay dividends and remuneration to family members not formally employed in the business and taxed. They would file quarterly reports – virtually identical to the VAT system – and pay over PAYE and NI relating to remuneration paid out by the company during that period. In this way, legitimate expenses – including pension contributions – can be charged in accordance with company and tax law and the engaging client companies have no responsibilities in this regard. If, and when wound up, any surplus would be deemed to be income of the Directors at the time of winding up and taxed accordingly, following the principle that all retained earnings from whatever source will eventually be taxed as income and as appropriate.

The arguments traditionally presented by HMG and HMRC are around concepts of tax-dodging and control processes. HMRC needs to charge and collect all due taxes as and when due and Government wants to control the workplace.

The Working Free view is that, now, workers – particularly at senior levels – think differently, behave differently and have different aspirations. We also contend that Atypical Working will soon represent about half the working population (now about 33m.) and should have appropriate recognition.

Recalling yesterday’s management buzzword “Empowerment”, what about the Government’s enthusiasm for working with ALL the talents.

The test is whether Labour can devise the Modern Industrial Strategy that it says it can and can it organise the human resources to deliver it.

Smile at us, pay us, pass us; but do not quite forget,

For we are the people of England, that never has spoken yet.

GK Chesterton 1908

Section 4 – What has all this got to do with Growth? >>>

Section 4 – What has all this got to do with Growth?

- What has growth to do with Working Free?

- About the hysteria

- Have the right targets been identified?

- Growth means new money

- New money means exports.

- What to focus on? The key question

What has growth to do with Working free?

Working Fee beats the drum for senior people operating on an independent basis – a key component in the Atypical worker segment. It’s not possible to beat this particular drum without saying what Atypical workers do and in particular what do they do to promote growth.

Here are some important applications.

Most Independents operating at senior levels do it because they want to – are entrepreneurially minded and learn how to be good at getting a flow of work. Well suited to selling more goods and services to more foreigners.

About the hysteria

Don’t you think that this single word – Growth – is the most over-used, widely abused and certainly unexplained word current today amongst politicians, economists, business leaders, even people in pubs – and the media.

No-one has taken the trouble to say what it actually is – who has to do what, when and how. It is almost like all has been written into the documents – and that is all you need to do.

Working Free offers this:-

Growth is more businesses and their people selling more goods and services to more foreigners.

Growth starts with one business and its people selling one product to one foreigner.

Those who don’t know how should call the Department for Business and Trade.

Have the right targets been identified?

The main thrust of Invest 2035: is to focus on key sectors – primarily top end advanced technology and manufacturing. How can this approach be best made realistic, given the inexorable decline in the UK manufacturing sector – now only 9.4% of national GDP. (where is the low-hanging fruit?)

Below we compare the lists of Labour, of Make UK and of the Conservatives.

The Government states: –

“The industrial strategy will focus on the sectors which offer the highest growth opportunity for the economy and for business. Eight growth-driving sectors have been identified:”

- advanced manufacturing

- clean energy industries

- creative industries

- defence

- digital and technologies

- financial services

- life sciences

- professional and business services

If you compare this list with what Make UK and the Conservatives say and have said, there is a remarkable consensus. See below.

(In Bold – above – are services – as opposed to Manufacturing. These three actually account for a major part of all services exported. The UK is the second biggest exporter in the world – of services. More focus, support and promotion needed.

The other five sectors have been identified as growth ones – and will be targeted. These five sectors are clearly important ones but are currently fairly modest in volume and technical maturity and varying degrees of catch-up will be required to compete effectively internationally. It is worth bearing in mind that manufacturing accounted for 17% of the UK economy in 1990 but now accounts for 9.4%. The other 90.6% relates to Services.

Realistically, they must have enough to get started now to meet the Spring publication date. The key task is to decide the order of approach. Not everything can be done at once.

Make UK urges the government to focus on Manufacturing (which is what they do!) They see the following as key areas of strength –

- aerospace,

- pharmaceuticals,

- luxury car making

Frontier technologies such as ……..

- artificial intelligence

- Nuclear small modular reactors SMRs

- quantum computing and

- floating offshore wind turbines.

The previous Conservative Government made a fairly similar choice.

The then Prime Minister and Chancellor published in January 2014 the Conservative’s Industrial Strategic Plan for 2024 in summary format – and which was the same for 2023. What they did with this afterwards is not evident.

The key growth sectors were: –

- Digital Technology,

- Green Industries, ( five sectors in the clean energy industry – carbon capture, utilisation and storage, electricity networks, hydrogen, nuclear, and offshore wind)

- Life Sciences,

- Advanced Manufacturing and

- Creative Industries to increase their investment in the UK, (Working Free Section:- Creative Industries are one of the UK’s major strength and leading exports.)

What is noticeable with all of these is that the sector focus seems to be where union representation is relatively low. Most of the selected sectors call for clever, mobile, higher-educated people with a good knowledge of their sector technology and of general business skills. The more you have of this, the more successful they and their businesses would likely be.

The Conservatives had Five Key Priorities. (three out of five relate to the Economy.) These are inextricably linked to identifying the right targets-

- Halve inflation. Mostly, Inflation, actually, sorted itself out when the spike due to the energy crisis became more than one year old and oil prices actually reduced. Moving into 2025, inflation looks like it might come from different sources.

- Grow the economy. Not discernible by anyone.

- Reduce debt. Not discernible by anyone. Labour will be increasing debt

- Cut waiting lists. Not discernible by anyone.

- Stop the Boats. Not discernible by anyone.

The Conservatives also had three building blocks, essential for much bigger ambitions for the years beyond. Also inextricably linked to identifying the right targets

- “World-beating enterprises to make Britain the world’s next Silicon Valley.Some observers might conclude that this objective is simply too ambitious – but still sensible to actually start the journey.

- “An education system where world-class skills sit alongside world-class degrees.”This should be achievable – but certainly – and now – this has developed into an established export activity – Universities, Independent Schools, smaller private initiatives, Professional Bodies and, often overlooked, the UK armed forces. eg; Sandhurst training overseas soldiers (Ukraine, currently).

The Government’s VAT and business rates changes for independent schools – which means that foreign students will now have to pay extra – will damage this export business. It is reported that about 15% of student headcounts are currently overseas students.

- “Employment opportunities that tap into the potential of every single person so businesses can build the motivated teams they need. “ And opportunities spread everywhere just as our talent is spread everywhere. “This is a vital objective – and an urgent one. Working Free contends that there are not enough Workers to do what is needed.

Sounds sensible to suggest that the Labour Government should pick up all this. If not reflected in their Strategic Plan – Invest 2035:

What is noticeable is the amazing level of agreement between the three organisations. The differentiator lies in the ability to deliver.

Growth means new money.

Since 1948, there have been only 18 years in which exports have exceeded imports. Apart from an accidental one in 2020, the last real surplus was in 1997. Unless this can be turned around………….

Current money means re-circulated, indigenous money. New Money is money from outside the UK economy and sources are well-rehearsed.

Internal sources of money include one or more of finding out who has the money and taking it off them, exploiting natural resources, borrowing it or earning it.

The Labour Government has now taken further what the previous Government has been doing more or less throughout its 14 years in office – stealthily and indirectly taking money off people. (See SECTION below about NI)

- Finding people to tax is an ongoing process:- still plenty of rich people around – including royalty, according to some recent media comments.)

- Sadly, we’ve run out of natural resources to dig out of the ground.Good news about green energy – but less good news when we learn that Trump will be drifting back to fossil fuels – no doubt peaking when we have shut down most of our production. And China and maybe India are sharing Russia’s oil. They probably always were.

- We – supposedly – can’t borrow any more. (Good luck to Labour in testing out if we can borrow more – and recouping it before it starts to matter.)

- So, “Earning it” is looking very much like the only option left.

Note: About Employers’ National Insurance (NI)

NI – and the recent increase – will be paid by businesses but the almost obligatory and sensible – reciprocal from Government should be to enable them to cover these costs in extra sales and margins. (Usually referred to as Productivity.) Affected businesses need to feel that Government is taking positive steps to create more business, more opportunities, greater preparedness to do better in their businesses. Otherwise, it is little more than a wealth redistribution exercise.

Many organisations calculated and published their estimated extra NI costs. Which is interesting. But not much more than this.

Responses and options – apart from just paying the extra – or passing them on in varying ways to customers – it could be similar to their Covid reactions. These include reorganising and absorbing the workload into existing roles or rewriting internal processes or by further computerisation.

However, in this case, money from furlough, support loans and grants came to the rescue – much never paid back. This won’t be available again.

For the smaller businesses, they may decide to retrench, focussing on a small, simpler business and, possibly, more of a lifestyle choice, avoiding expansion. This means NOT hiring permanent staff. They may rationalise this by taking the view that hiring permanent staff is simply not worth the effort.

- Or they may just pack it all in which would be a great sadness.

- Supporting all this and as background, delving into statistics relating to immigration, emigration, movements of business people and others around the world – could be for projects, as secondments – or permanently – can be a helpful process. Probably more choices available for working people and others than ever before.

- They may explore the new thinking and legislation around flexible working. Much of this is part of what is referred to as “Atypical Working”

Read what Working Free has to say about this later in this Paper

New money means exports.

Invest 2035: does not acknowledge that the only viable way of generating sufficient national wealth to pay for what both Government and the people want is by selling more goods and, importantly, more services to more foreigners.

The story of the UK as a global trading nation is and has been one of gradual decline – since the Empire peaked around 1910 and 1920.

Reversing this can realistically only mean selling more goods and services to more foreigners.

If the Labour Government are saying they can fix this decline – and it would appear that this is what they are saying – or will be achieving it when their new Strategic Plan kicks in, then the fullest support should be enthusiastically provided to them.

No-one wants this major project to turnout like HS2 or The Post Office. In fact, most major Government projects do not end on budget and on time. Partly this reflects the sheer size, complexity and genuinely unforeseen events but it also is some reflection on Government’s cability to run major projects.

Going back to 1948………………. (See House of Commons Library and ONS) the UK has recorded a trade deficit (meaning the value of imports exceeded the value of exports) in its combined trade in goods and services for 58 out of the 76 years since 1948. 2020 was an exception during the COVID-19 pandemic. This was due to a decrease in imports to London, while exports remained relatively stable. The last time the UK had a surplus was in 1997.

The UK’s trade with the Commonwealth also resulted in a surplus in 2023, with services accounting for the majority of trade.

Within this, the UK has recorded a trade surplus (meaning the value of exports exceeded the value of imports) 18 times since 1948. For 58 years, it didn’t. The longest sustained period of trade surpluses was the 9 years between 1977 and 1985. The remaining 9 were recorded between 1956-58, 1969-71 and 1995-97

Surpluses and Deficits

Surpluses mean more profit in the P&L Account which means more cash which also means that Government can tax it. Who could complain about that – particularly when it’s the Government that may well have helped make that profit?

- In 2019, the UK’s trade deficit was £30.5 billion, equal to -1.4% of GDP. This represents a widening of the trade deficit from 2018 when it was – £25.5 billion, equal to -1.2% of GDP.

- In 2023, the UK’s exports of goods and services totalled £861 billion and imports totalled £876 billion. The EU accounted for 41% of UK exports of goods and services and 51% of imports in 2023.A deficit of £188 billion on trade in goods was partly offset by a surplus of £173 billion on trade in services in 2023.

- The overall EU trade deficit was £15 billion in 2023. No-one seems bothered much about this. Compare this with the consternation caused by Labour complaining about the black hole of £22bn when assuming office. It is the Micawber Principle – money coming in has to exceed money going out!

- The UK had a trade deficit with the EU of £95 billion in 2023 and a trade surplus of £80 billion with non-EU countries. The trade deficit with all countries decreased to £10.6 billion in Q3 of 2024 compared to £15.9 billion in the previous quarter.